Vancouver, Canada – March 12, 2020 – Nexus Gold Corp. (“Nexus” or the “Company”) (TSX-V: NXS, OTCQB: NXXGF, FSE: N6E) is pleased to announce that has entered into an agreement, dated effective March 6, 2020, with Union Gold Inc. and Margaret Duffitt (collectively, the “Vendors”) pursuant to which the Company proposes to acquire the Dorset Gold Project. The Project consists of a series of mineral claims located in the Province of Newfoundland, south of the Pine Cove Gold Mine.

The Dorset Gold Project is a 275-hectare land package containing multiple gold occurrences and mineralized zones. The Main Zone includes three historic occurrences, with up to 409 grams-per-tonne (“g/t”) gold (“Au”) in grab samples, with channel sampling results of 177 g/t Au over 0.35m, 22 g/t Au over 1.5m, 17.2 g/t Au over 1.5m, and 14.7 g/t Au over 1.5m. Historic drilling includes DDH 87-1 which intersected 9.5 g/t Au over 1.3m (MacDougall, 1990). * The reported drill intercept is an intersected length and is not a true width.

Historic select sampling at the Braz Zone returned values of 314 g/t Au, 40 g/t Au, 31.4 g/t Au, 21.2 g/t Au, 19.2 g/t Au, and 14.8 g/t Au. Historic channel sampling across the vein, returned 9.5 g/t Au over 0.4m; 5.7 g/t Au over 0.5m and 1.2 g/t Au over 0.65m. Weighted averages of historic rock sampling encompassing vein and mineralized wall rock returned values of 5.8 g/t Au over 1.9m; 3.1 g/t Au over 2.0m and 2.5 g/t Au over 1.5m (MacDougall, 1990).

Other zones include the Albatross, where historic rock sampling of mineralized zones returned values up to 9.6 g/t Au and locally up to 30.3 g/t Au. Assay results from three 1987 diamond drill holes include 1.0 g/t over 7.3m, 1.81 g/t over 4.3m and 1.02 g/t over 2.2m; the Phoenix Zone where grabs of altered gabbro assayed up to 5.8 g/t Au, 5.5 g/t Au, and 3.3 g/t Au and diamond drill hole intersection of 1.07 g/t Au over 5.45m; and the Gunshot Zone, where veins contain visible gold and pyrite, returned grab samples collected from the veins have assayed up to 162 g/t Au and channel samples have assayed up to 18.0 g/t Au over 0.4m (MacDougall, 1989). * The reported drill intercept is an intersected length and is not a true width.

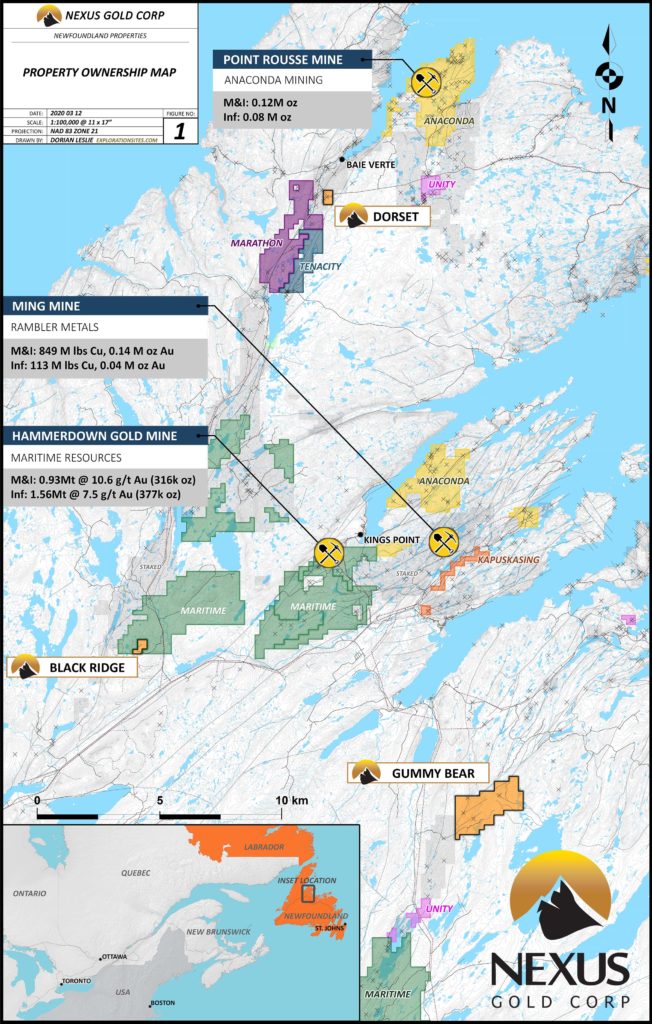

Figure 1: Nexus Gold Newfoundland Project Map

Terms

In consideration for the acquisition of the Dorset Gold Project, the Company is required to issue 11,000,000 common shares. The Company is also required to grant a two percent net smelter returns royalty on commercial production from the Project, one-half of which may be purchased at any time for a cash payment of $1,000,000. In connection with completion of the acquisition, the Company also intends to issue 550,000 common shares to an arms-length party which assisted with introducing the opportunity to the Company. The Company is at arm’s length from the Vendors, and the acquisition of the Project does not constitute a fundamental acquisition under the policies of the TSX Venture Exchange. All securities to be issued in connection with the acquisition of the Project will be subject to a four-month-and-one day statutory hold period in accordance with applicable securities laws. The acquisition remains subject to the approval of the TSX Venture Exchange and cannot be completed until such time as approval is obtained.

* Please note that grab samples are selected samples and are not necessarily representative of the mineralization hosted on the property.

Warren Robb P.Geo., Vice President, Exploration, is the designated Qualified Person and has reviewed and approved the technical information contained in this release. The historic data contained in this releases was verified by the QP by comparing reported assay data with Certificates of Analysis documented, the QP has not verified mineral showings or drill hole locations or taken check samples in the field, due to current winter conditions, but will do so once the property becomes accessible in the spring. It is the QP’s opinion that the data as presented is adequate and can be relied upon for use in this press release.

About the Company

Nexus Gold is a Canadian-based gold development company with an extensive portfolio of ten exploration projects in West Africa and Canada. The Company’s West African-based portfolio totals five projects encompassing over 750-sq kms (75,000+ hectares) of land located on active gold belts and proven mineralized trends, while it’s 100%-owned Canadian projects include the McKenzie Gold Project in Red Lake, Ontario, the New Pilot Project, located in British Columbia’s historic Bridge River Mining Camp, and three prospective gold-copper projects (3,300-ha) in the Province of Newfoundland. The Company is focusing on the development of several core assets while seeking joint-venture, earn-in, and strategic partnerships for other projects in its growing portfolio.

For more information please visit nexus.gold.

On behalf of the Board of Directors of

NEXUS GOLD CORP.

Alex Klenman

President & CEO

604-558-1920

info@nexusgoldcorp.com

www.nexusgoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.